India’s generative AI (GenAI) boom has reached a major tipping point. In just the first seven months of 2025, Indian GenAI startups secured a record $524 million in funding—a fourfold jump from 2021—making global investors sit up and take notice. As the world’s largest talent provider and digital market, India is poised to become a major force in the global AI landscape this year.

India’s GenAI Moment Arrives

A silent revolution is reshaping Indian technology. From automating e-commerce to revolutionizing healthcare, Indian GenAI startups are leading a market surge unlike anything seen before. The catch? The US$524 million invested in the sector by mid-2025 represents only the beginning. With massive government support, swelling venture capital, and a vibrant pool of digital talent, 2025 is being called “India’s AI Startup Year”—a watershed for innovation, jobs, and global influence.

Why the Indian GenAI Boom Now?

Once-in-a-Generation Market Drivers

Several key factors have catalyzed India’s AI acceleration in 2025:

- Digital India Initiatives: Government programs like Digital India have supercharged tech adoption nationwide.

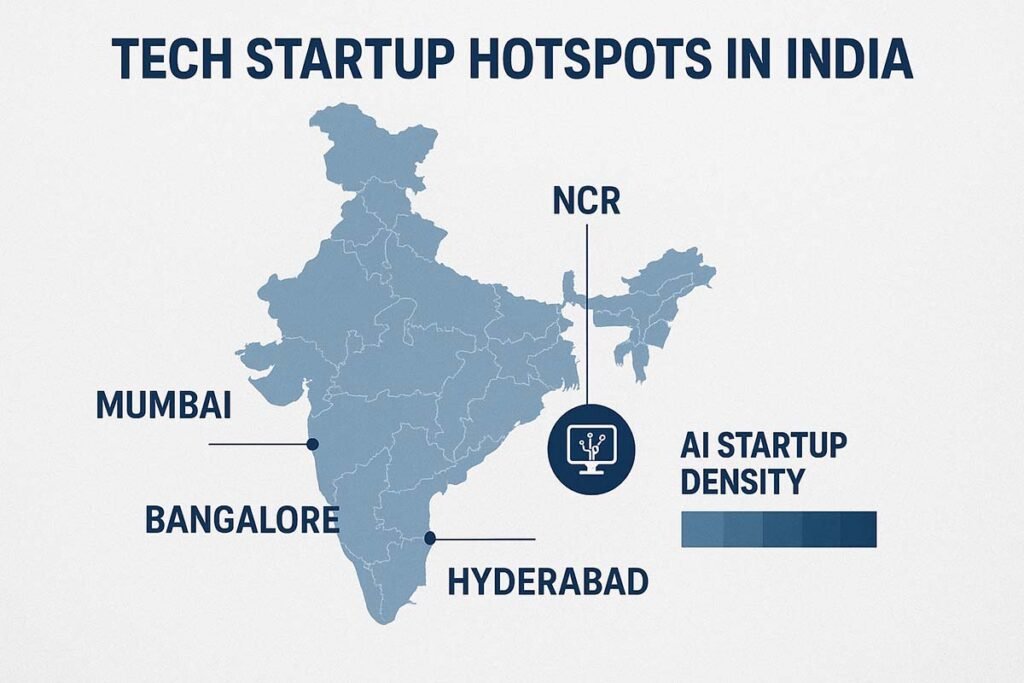

- Vast Talent Pool: With over 6,200 AI startups and a tech-savvy workforce, India is primed for innovation.

- Investment Momentum: Domestic and global VCs are pouring funds into GenAI startups, quadrupling investments since 2021.

- Enterprise Digital Transformation: BFSI, e-commerce, IT, healthcare, and logistics are rapidly integrating AI solutions for efficiency and customer insights.

- Government Support: Policies, grants, and public partnerships are fostering a thriving startup ecosystem.

Impressive Growth Rates

| Year | Indian GenAI Market | Investment in GenAI Startups | AI Startup Count |

|---|---|---|---|

| 2021 | $129M | $129M | ~4,500 |

| 2024 | $1.0-1.3B | $475M | ~6,200 |

| 2025 | $7.31B [estimate] | $524M (Jan–Jul) | >6,200 |

Sources: Statista, Grand View Research, ET, TechSci Research

Top Sectors Driving the Boom

- Enterprise Software (automation, customer support, data analytics)

- Healthcare (diagnostics, research, telemedicine)

- Finance (fraud detection, risk analysis, personalized services)

- Retail & E-commerce (product recommendation engines, virtual shopping assistants)

- Media & Entertainment (content generation, dubbing, personalization)

The Anatomy of India’s GenAI Startup Surge

Record Funding & Global Attention

- Indian AI startups raised $524 million in just the first seven months of 2025—more than four times the amount from 2021 and the highest in five years.

- Key investment magnets include Fractal Analytics, AtomicWork, and TrueFoundry, with VCs such as Elevation Capital, Accel, and Sequoia betting big on AI.

- Deal flows are accelerating, with leading VC firms closing three times more AI deals compared to earlier years.

India’s Role on the Global Stage

- India now accounts for 6.1% of the global GenAI market revenue.

- The GenAI market could add $450–$500 billion to India’s GDP by 2025—10% of its $5 trillion economic target.

- Globally, only the US and China see comparable GenAI market expansion.

Real-Life Examples: Indian GenAI Startups Making Headlines

Standout AI Innovators

- Krutrim AI: Founded by Bhavish Aggarwal (Ola), focuses on India-centric large language models that support multiple languages and cultural nuances.

- Sarvam AI: Pioneers of open-source LLMs trained on Indian data, enabling local enterprises with sovereign and secure AI tools.

- Fractal Analytics: Enterprise-focused platform for AI-driven insights, helping Fortune 500 clients automate and optimize operations.

- AtomicWork: Delivers agent-based AI solutions for workflow automation in large corporations.

- TrueFoundry: Offers scalable platforms for building, deploying, and managing advanced machine learning models.

- AdoptAI, Composio, Maxim: Innovative GenAI startups attracting venture capital for solutions spanning HR automation, content generation, and more.

Case Study: Krutrim AI

Krutrim AI’s large language models are revolutionizing call centers with fully automated, multilingual support for banks and retailers. With $100 million in Series A funding, Krutrim is the first Indian startup to build LLMs rivaling global giants, supporting India’s push for sovereign AI.

The Challenges: Growing Pains in India’s AI Story

While the growth is exciting, several hurdles must be overcome:

- Funding Constraints: Compared to Silicon Valley, India’s ecosystem still faces capital access limitations.

- Talent Drain: Many top researchers move abroad or to global tech firms, creating skill gaps in startups.

- Data Privacy & Ethics: There’s a lack of clear regulatory frameworks for ethical AI, data security, and privacy.

- Infrastructure: Startups often struggle with access to large, high-quality datasets and robust compute power.

- Scaling Barriers: Bureaucratic sales cycles, IP protection issues, and high project failure rates (reportedly up to 90%) challenge sustainable growth.

Solutions Emerging

Industry-academia partnerships, government initiatives on AI upskilling, and international collaboration are slowly bridging these gaps in 2025.

Government & Policy Support: A Transformational Push

The Indian government is actively supporting GenAI growth with:

- AI-specific investment funds and grants for early-stage ventures.

- Digital India and National AI Mission programs to enhance public AI literacy and adoption.

- Partnerships with global tech leaders for R&D and training.

- Launch of talent hubs and AI-specific training programs—India’s AI industry workforce is expected to reach $28.8 billion in value by 2025.

US Audience: Why American Innovators and Investors Watch India in 2025

Compelling Reasons for US Engagement

- Complementary Strengths: India offers massive engineering talent, competitive cost structures, and a rapidly-growing domestic market.

- US-India Tech Collaboration: Strategic partnerships and joint research in GenAI, cloud, and cybersecurity are deepening.

- Market Expansion: US companies and VCs are finding lucrative opportunities by partnering or investing in Indian AI ventures.

US–India GenAI Collaboration Highlights

Expert Opinions

- Krishna Mehra (AI Partner, Elevation Capital): “The next 12-24 months will see more world-class GenAI companies coming from India”.

- Mohamad Faraz (Managing Partner, Upsparks Capital): “AI startup deal momentum in 2025 outpaces everything we’ve seen before.”

- NASSCOM Insights: “India’s GenAI ecosystem stands at a transformative inflection point in 2025, with depth in both capability and market reach”.

Comparative International Perspective

- While US GenAI startup funding still leads globally, India’s rapid pace and unique strengths (like multilingual AI and frugal innovation) make it the world’s fastest-growing major AI market.

- China is projected to lead the Asia-Pacific regional market by absolute revenue, but India is recognized for innovation and adaptability.

Practical Opportunities for the US Audience

- Investment: VC and private equity funds targeting Indian GenAI startups.

- Partnership: Joint ventures, tech transfer, and equity deals.

- Recruitment: Access diverse AI talent and offshore R&D capabilities.

- Go-to-Market: US software companies expanding AI-driven products to the Indian and emerging global market.

The Road Ahead: What’s Next for India’s GenAI Ecosystem?

By 2030, forecasts suggest the Indian GenAI market will reach $8.3 billion, with GenAI startups playing a central role in sectors from logistics to media. Expect:

- More unicorns and exit opportunities.

- Deepening US–India AI alliances.

- Sovereign Indian AI models tailored for local languages and compliance.

- Government and VC investment sustaining the innovation engine.

India’s $524 Million GenAI Boom Sets the Stage

India’s generative AI sector is experiencing explosive, historic growth in 2025. Fueled by a robust talent pool, swelling capital inflows, supportive policies, and a vibrant startup ecosystem, this is the year Indian GenAI will become a global powerhouse. For US investors, tech leaders, and global AI enthusiasts, 2025 is India’s must-watch moment for transformative AI breakthroughs.

Ready to watch the world’s next AI revolution? Subscribe for updates, or connect with Indian GenAI leaders for collaboration and investment.

FAQs

Q1: Why is 2025 called India’s AI Startup Year?

A1: Indian AI startups secured $524 million in funding by mid-2025, the highest ever, fueled by investor confidence, enterprise adoption, and government support.

Q2: Which sectors are Indian GenAI startups disrupting the most?

A2: Major impact includes enterprise software, healthcare, financial services, e-commerce, and media, with customized AI solutions across segments.

Q3: Why are US investors and companies interested in Indian GenAI?

A3: India’s large talent pool, innovative approach, and competitive costs, combined with soaring market growth, make it an attractive destination for collaboration and investment.

Q4: What unique challenges do Indian GenAI startups face?

A4: Funding limitations, talent gaps, data infrastructure issues, and regulatory hurdles around data privacy and IP protection.

Q5: What’s the projected size of the Indian GenAI market?

A5: Estimates for 2025 range from $7.31 billion to $8.3 billion, with tripling expected by 2030.

Q6: How is the government supporting Indian AI growth?

A6: Through public investments, favorable policies, Digital India programs, and AI talent development initiatives.

Q7: What are some leading Indian GenAI startups to watch?

A7: Krutrim AI, Sarvam AI, Fractal Analytics, AtomicWork, and TrueFoundry are pioneers in foundational and applied GenAI.

Q8: How can US companies and investors engage with India’s AI ecosystem?

A8: Through venture investments, strategic partnerships, talent exchange programs, and market entry strategies focused on AI and digital transformation.

Pingback: Multimodal AI: The Technology That Finally Makes AI Understand Like Humans Do - FirstsPost